When you consider the persona of a luxury traveler, what comes to mind? Is it first-class tickets and exclusive destinations? Five-star hotels and personalized reservations? The luxury segment is expected to grow faster than any other in travel, making it an opportune time to reestablish exactly who makes up this demographic and what they expect.

According to McKinsey & Company’s 2024 State of Tourism and Hospitality, many previously held perceptions of luxury travelers are inaccurate or incomplete. Here’s a closer look at how the luxury travel sector has evolved and what it means for the future of tourism and hospitality.

Not All Travelers Are Very Wealthy

Luxury travel is no longer reserved for high-net-worth individuals (i.e., those with assets valued at $1 million – $5 million). In today’s market, 35% of luxury travel is among individuals with $100,000 – $1 million in assets. This cohort has been coined “aspiring luxury travelers” and has distinct preferences compared to the aforementioned group, which prefers privacy, exclusivity, and personalized or boutique service.

Aspiring luxury travelers seek visible luxury and value, often using loyalty programs and branded experiences to validate their choices. They are willing to splurge on certain aspects of a trip but look to cut costs elsewhere.

Though they are not the majority of the luxury sector, the non-millionaire segment is still significant. By 2028, individuals aged 30 – 50 are projected to spend $213 billion on luxury travel (up from $118 billion in 2023).

This younger segment presents an opportunity to build brand loyalty and capitalize on high lifetime values, especially as some will move into higher net worth tiers. Many in this demographic also have families, prompting luxury providers to create offerings that cater to both parents and teens.

Traditional Trips Hold Value

Luxury travelers are known to seek unique and exotic experiences, like yachting trips or safaris. And although the luxury traveler is more likely to take a specialty trip, they also appreciate traditional leisure activities, with 65% seeking sunny beach vacations. In fact, sun and beach vacations are the top choice for luxury travelers.

McKinsey frames this as an opportunity for luxury brands to innovate within familiar settings. By supporting upgraded accommodations and curating activities to keep destinations fresh and appealing, the luxury traveler can take a traditional trip and still find the novelty they seek.

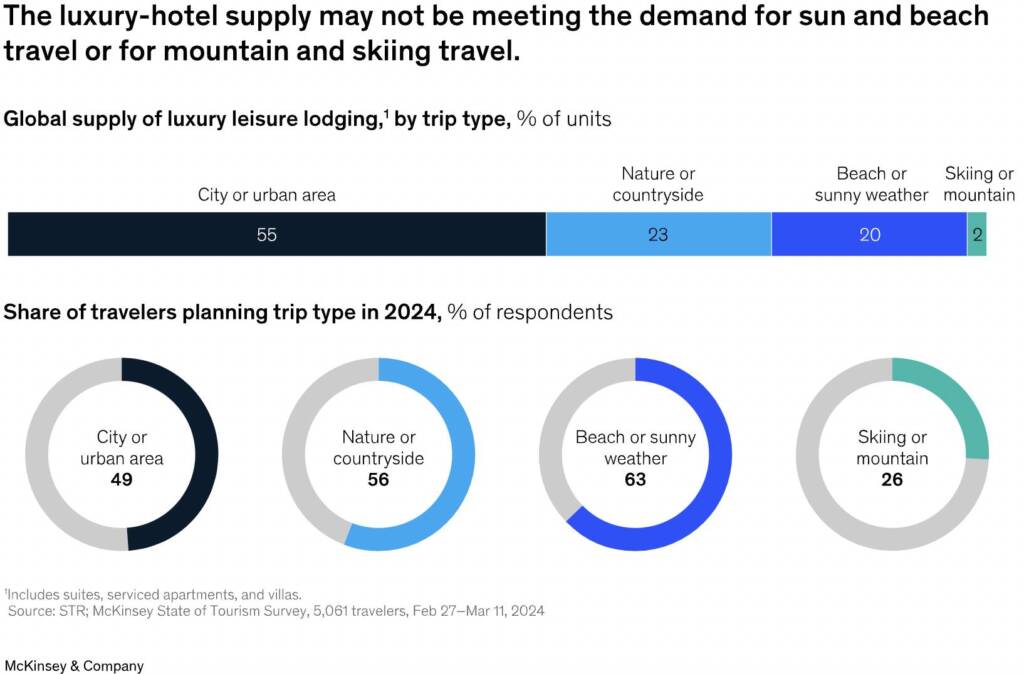

Luxury Hotel Supply Is Lacking

When considering the supply of luxury accommodation in top destinations, McKinsey & Company found a lack of hotels for both beach and skiing destinations.

Short-term rentals can meet this demand by tailoring their offerings to luxury preferences. Loyalty programs that recognize and reward valued customers with attentive service, personalization to preferences, and exclusive privileges are effective strategies.

Understand Your Data to Understand Your Guests

Building loyalty amongst luxury travelers requires knowing who they are. By calculating the lifetime value (LTV) of contacts and past guests, vacation rental managers can effectively segment the luxury cohort. Aidaptive’s Predictive Hospitality Platform uses AI models and first-party booking data to generate LTV predictions for each customer to power this segmentation. With this information, vacation rental managers can make informed strategic decisions and implement personalized sales and marketing strategies for luxury travelers and other unique segments.

Contact us for more information and to schedule your live demo of Predictive Hospitality. Understand the power behind AI and data-drive customer segmentation today.

Sign up for The Predictive Hospitality Newsletter.